What Are the Two Basic Types of Product Costing Systems

Explain the cost flow in a manufacturers job order costing system. Department and plant B.

Cost Hierarchy Meaning Levels And Example Accounting Education Accounting And Finance Economics Lessons

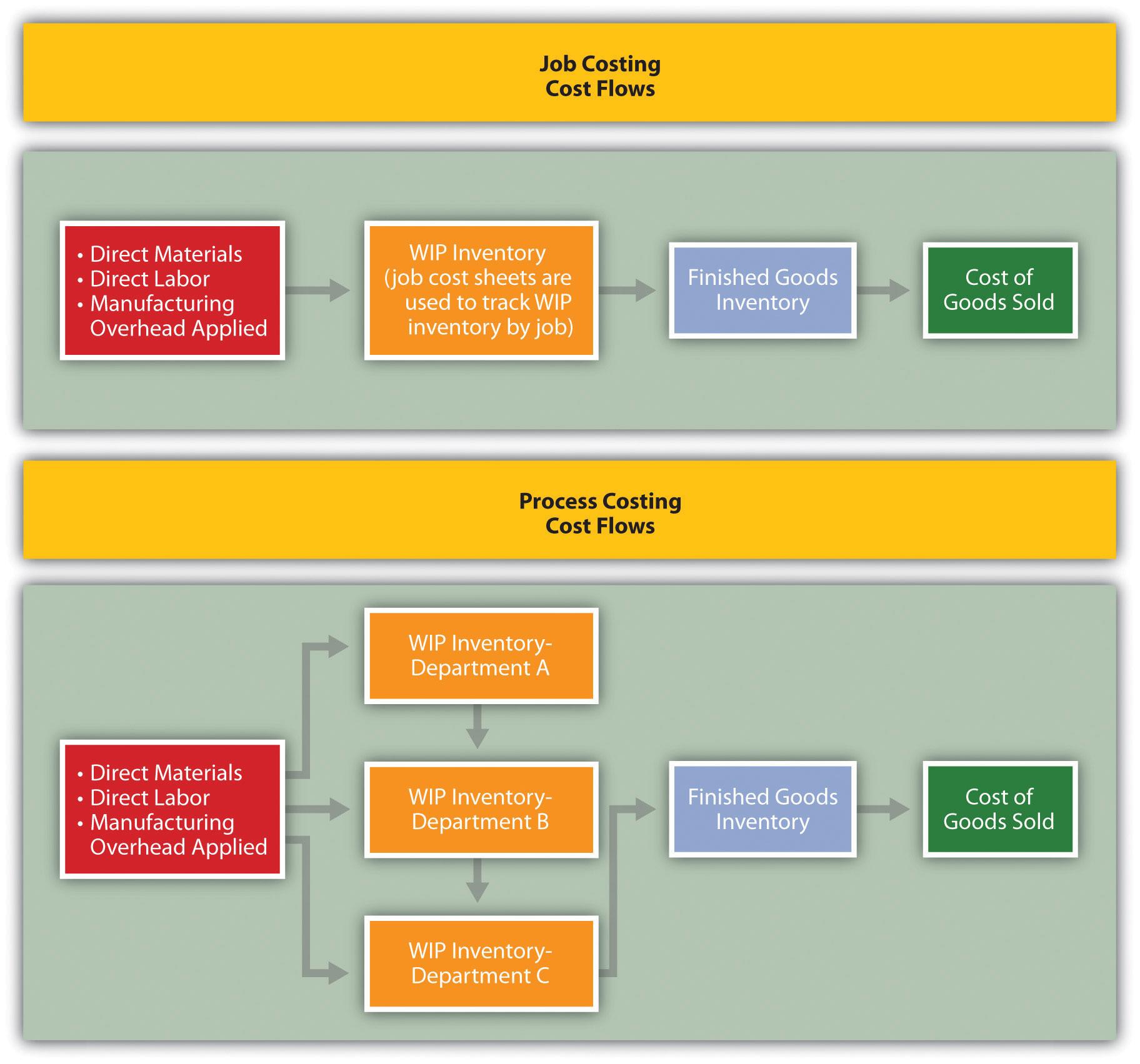

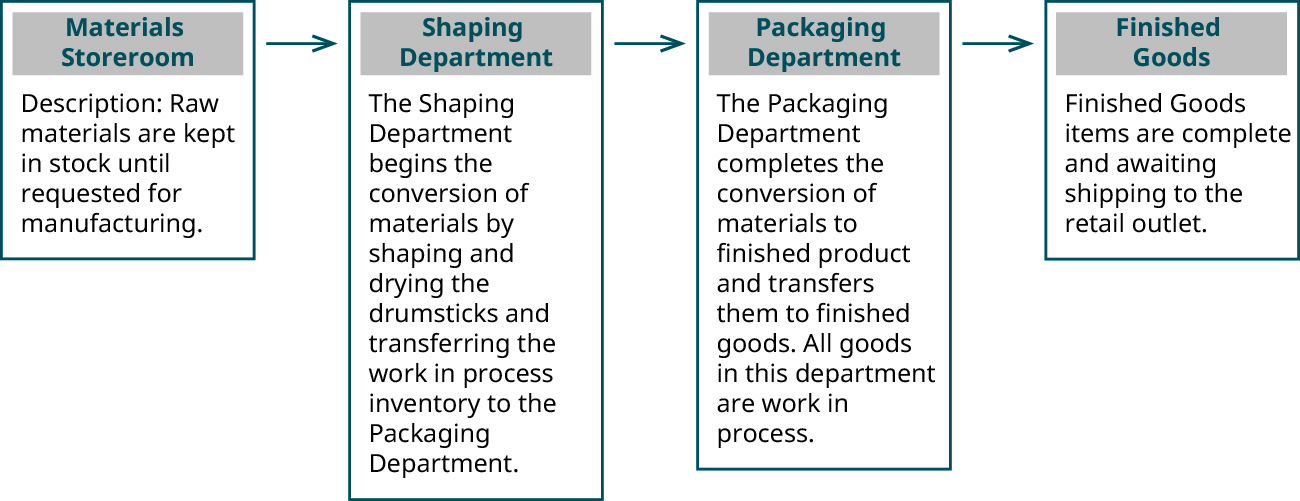

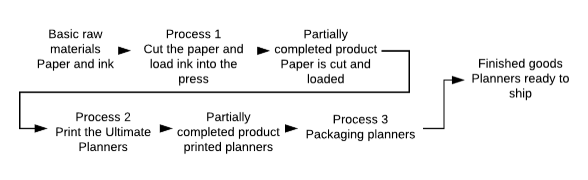

12262021 Process Costing Collects costs by process ie.

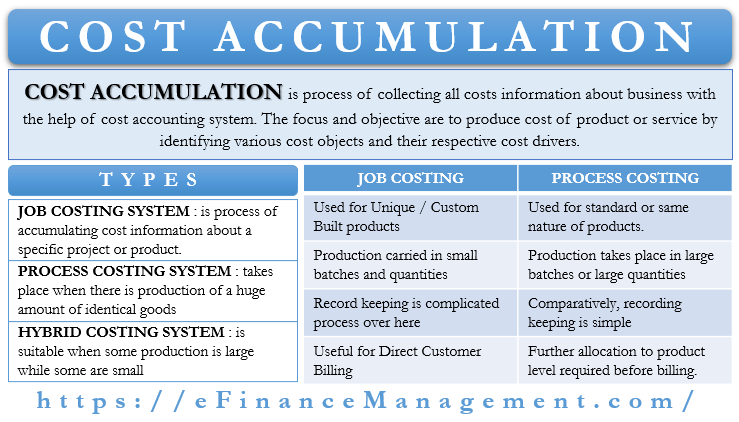

. The two basic types of product costing systems are. The main costing methods available are process costing job costing direct costing and throughput costing. Accounting questions and answers.

Product costing methods are used to assign a cost to a manufactured product. What are the two basic types of costing systems. Activity-based costing The two basic types of product costing systems are A department and plant.

Explain the cost flow in a manufacturers job order costing system. Hence different types of methods of costing are utilized by various different industries in the market. Variable costing and absorption costing.

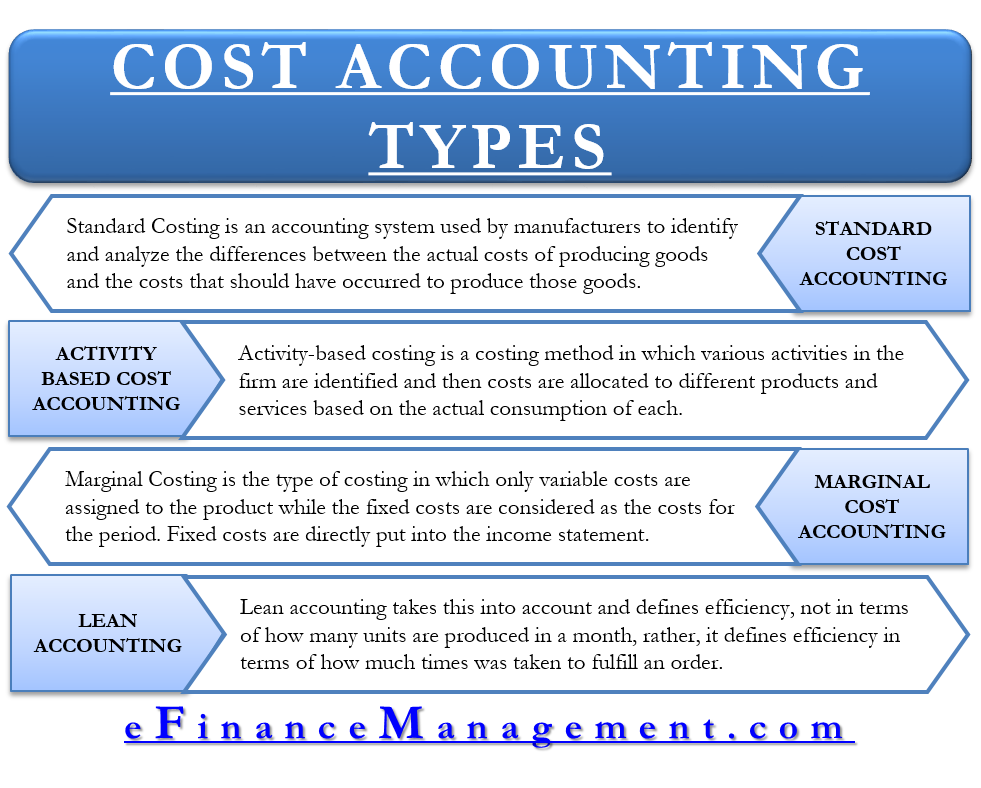

Job process Which of the following product costing systems is normally used to assign costs to goods that are mass-produced goods. Even though two more costing methods are generally used by some manufacturing concerns. In conjunction standard costing backflush and activity-based costing are effective costing methods that companies also use.

Job process C. Department plant B. What are the two basic types of product-costing systems.

Costs are collected on a job cost record. Activity-based costing ABC is a method of assigning costs to products or services based on the resources that they consume. FIFO and weighted - average D.

Each industry in the market differs in its nature in the products they produce and sell and the kind of services they offer. Some companies decide to use both. Variable process D.

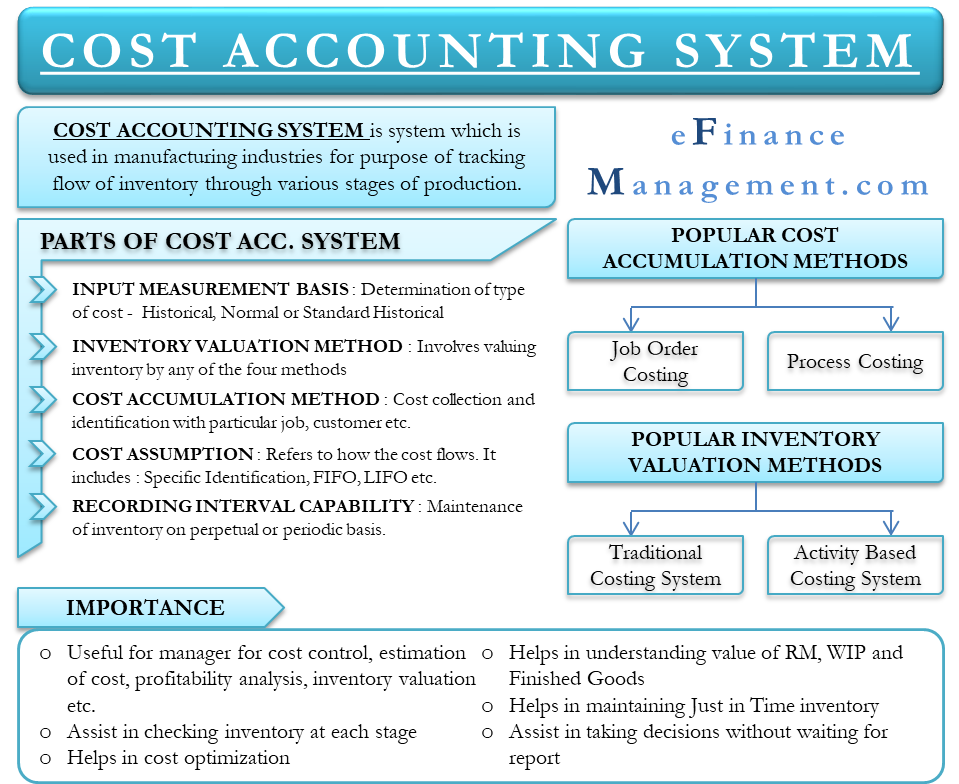

Generally the method of costing in commerce refers to a particular system of cost ascertainment and cost accounting. The following points highlight the top six types of costing systems. Basically costing is divided into two methods.

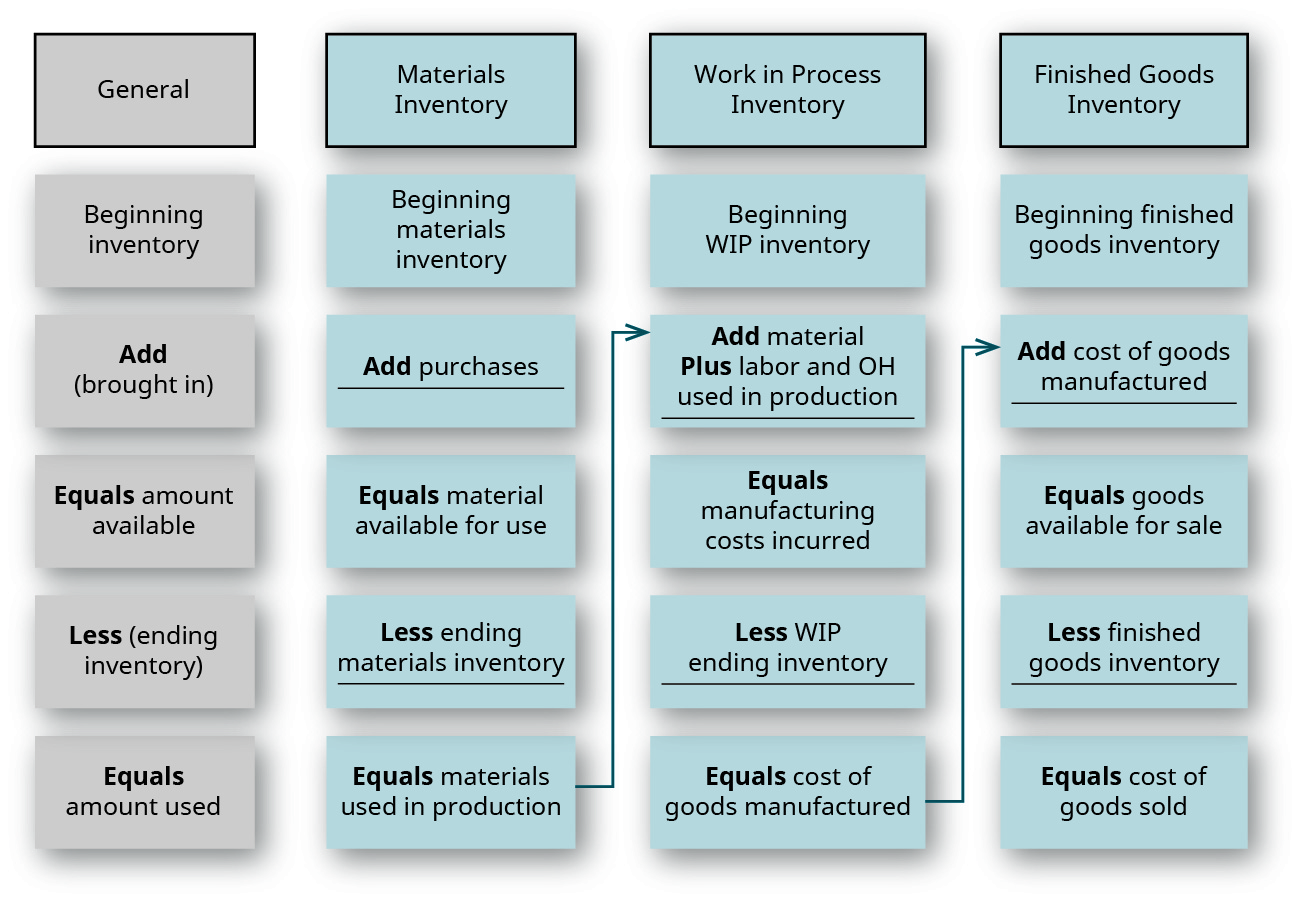

Job and process C. Specific Order Costing 2. How are manufacturing costs treated in process costing.

It then assigns the cost of these activities only to those products or services that are actually using them. Statement or answers the question 11 What are the two basic types of product costing systems A variable costing and process costing B FIFO costing and weighted-average costing C department costing and plant costing Drjob-costing andprecess costing 11 12 The system normally used to assign costs to goods that are mass-produced in. Describe the process costing system and identify the reasons for its use.

A job costing and process costing B department costing and plant costing C variable costing and process costing D FIFO costing and weighted-average costing In a process costing system the number of work in process inventory accounts is equal to which of the following. Material cost estimate with quantity structure works in combination of BOM Bill of Material and Routing assigned to it. One of the key differences between the two costing systems is that job costing is for different products and process costing is for multiple products that are the same or similar.

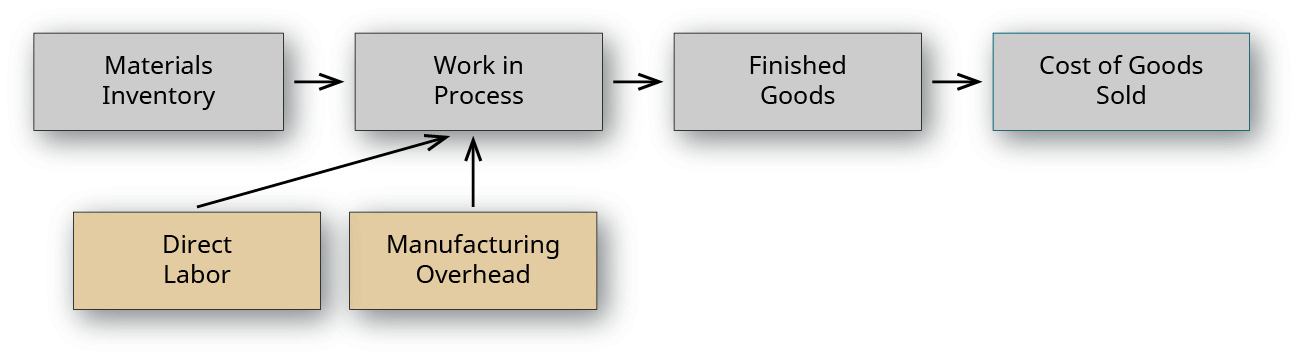

However job costing is used more by law firms accounting businesses and private investment companies whereas manufacturing companies use process costing. They are job costing and process costing. Direct labor from employee time records.

D job and process. See Page 1 What are the two basic types of product costing systems. The following are the most common types of cost accounting used by an organizations internal finance or management team.

The two basic types of product costing systems are. Web link Product costing systems APA format Product costing systems 2022. For costs the primary two cost accounting methodologies are job costing and process costing.

Product costing methods may be grouped under the following three main categories. Activity-based costing first assigns costs to the activities that are the real cause of the overhead. Overhead charged using departmental rates.

Job costing is used most often when one-of-a-kind or distinct batches of product are produced. Absorption costing sometimes referred to as full costing is used by a company to determine all costs that go into the manufacturing of a specific product. A The manufacturing costs are added only when the goods are in finished inventory.

Job Costing In job costing actual costs are tracked and allocated to a specific product or batch. Organizations that make custom unique or special-order products typically use a job order costing system. In this type of costing system the costs are ascertained only after they have been incurred.

Variable costing allocates only variable manufacturing overheads to inventories while absorption costing allocates both variable and fixed manufacturing overheads to products. C variable and process. Based on whether the fixed manufacturing overheads are charged to products or not cost accounting systems have two variations.

This costing method involves allotting all. A product costing and materials inventory costing B job costing and process costing C periodic costing and process costing D periodic costing and perpetual costing. They are composite or multiple costing and farm costing.

Job-order costing and process costing Each distinctdifferent batch of production is a job or job order--products manufactured in low volumes Job-order costing Accumulates all production costs for a large number of units of output and costs are averaged over all the units--high volumes. FIFO weighted-average B. The most commonly contrasted cost systems are job order costing and process costing.

The two basic types of product costing systems are the job order costing system and the process costing system. B FIFO and weighted-average. Specific order costing method is the basic costing method applicable where work consists of separate contracts jobs or.

Such a system traces the costs of direct materials direct labor and overhead to a specific batch of products or a specific job order ie a customer order for a. Distinguish between the two basic types of product costing systems and identify the information that each provides. The basic principles underlying all these methods or types are the same.

Types of product costing methods. Continuous OperationProcess Costing 3. Direct materials based on material requisitions.

Each of these methods applies to different production and decision environments. Raw materials are easily traceable to a finished product. SAP provides two different types of material costing process viz Material cost estimate with quantity structure and Material cost estimate without quantity structure.

Types Of Cost Accounting Standard Activity Based Marginal Lean Efm

Peanut Butter Costing Meaning Example Drawbacks And More Learn Accounting Bookkeeping Business Accounting And Finance

Use The Job Order Costing Method To Trace The Flow Of Product Costs Through The Inventory Accounts Principles Of Accounting Volume 2 Managerial Accounting

Comparison Of Job Costing With Process Costing

Cost Accumulation Meaning Type Accumulation Vs Allocation More Efm

Flow Of Costs Job Order Costing Accounting For Managers

Jesse Balderas A Simple Understanding For What Standard Costing Is And What It S Not Standard Costing Is Connected With Jo Cost Accounting Job Understanding

Normal Costing System And Product Costs Double Entry Bookkeeping

Cost Accounting Systems Meaning Importance And More

Compare And Contrast Job Order Costing And Process Costing Principles Of Accounting Volume 2 Managerial Accounting

Flow Of Costs Process Costing Accounting For Managers

Manufacturing Burden Google Search Cost Accounting Business Planning Fixed Cost

Sap Controlling Product Costing Part 1 Sap Blogs

Describe And Identify The Three Major Components Of Product Costs Under Job Order Costing Principles Of Accounting Volume 2 Managerial Accounting

3 1 Process Costing Vs Job Order Costing Managerial Accounting

Systems Design Job Order Costing Ppt Download

Systems Design Job Order Costing Ppt Download

Absorption Vs Variable Costing Accounting Education Accounting Basics Accounting And Finance

Describe And Identify The Three Major Components Of Product Costs Under Job Order Costing Principles Of Accounting Volume 2 Managerial Accounting

Comments

Post a Comment